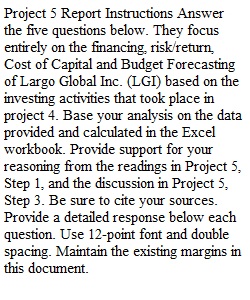

Q Project 5: Cost of Capital, Risk/Return, and Capital Budgeting Step 5: Prepare the Analysis Report for Project 5 You feel confident that your investment choices will positively boost LGI's productivity and improve the company's operations. Thanks to your efforts, the company will have a plan for financing its investments appropriately. LGI will finally be on a path of a sustainable future. Answer the questions in the Project 5 Questions – Report Template document. Prepare your analysis report including recommendations for how the company can improve its financial situation. Complete the analysis report: • Download the Project 5 Questions – Report Template • Read the instructions. • Answer all the questions. • Include your recommendations. • Submit the analysis report (Word document) and analysis calculation (Excel file) to the dropbox as your final deliverable at the end of Week 10. Label your files as follows: o P5_Final_lastname_Report_date.docx o P5_Final_lastname_Calculation_date.xlsx Check Your Evaluation Criteria Before you submit your assignment, review the competencies below, which your instructor will use to evaluate your work. A good practice would be to use each competency as a self-check to confirm you have incorporated all of them. To view the complete grading rubric, click My Tools, select Assignments from the drop-down menu, and then click the project title. • 3.1: Identify numerical or mathematical information that is relevant in a problem or situation. • 3.2: Employ mathematical or statistical operations and data analysis techniques to arrive at a correct or optimal solution. • 3.3: Analyze mathematical or statistical information, or the results of quantitative inquiry and manipulation of data. • 10.4: Make strategic managerial decisions for obtaining capital required for achieving organizational goals. Project 5 Report Instructions Answer the five questions below. They focus entirely on the financing, risk/return, Cost of Capital and Budget Forecasting of Largo Global Inc. (LGI) based on the investing activities that took place in project 4. Base your analysis on the data provided and calculated in the Excel workbook. Provide support for your reasoning from the readings in Project 5, Step 1, and the discussion in Project 5, Step 3. Be sure to cite your sources. Provide a detailed response below each question. Use 12-point font and double spacing. Maintain the existing margins in this document. Your final Word document, including the questions, should not exceed 5 pages. Include a title page in addition to the five pages. Any tables and graphs you choose to include are also excluded from the five-page limit. Name your document as follows: P5_Final_lastname_Report_date. You must address all five questions and make full use of the information on all tabs of project 5 as well as data in other Excel workbooks (e.g. from project 1: ratio, common-size, and cash flow analysis). You are strongly encouraged to exceed the requirements by refining your analysis. Consider other tools and techniques that were discussed in the required and recommended reading for Project 5. This means adding an in-depth explanation of what happened in that year for which data was provided to make precise recommendations to LGI. ? Title Page Name Course and section number Faculty name Submission date ? Questions 1. How would you assess the evolution of the capital structure of LGI? Reflecting on your work in Project 1, would you consider the risk exposure under control? If not, what are your recommendations? [insert your answer here] 2. What kind of information do you find valuable in CAPM to guide you in assessing the risk of LGI compared to other firms and the market in general? [insert your answer here] 3. Identify and differentiate the stakeholders of LGI and explain how each one should perceive and weigh the risk and/or return of the firm. [insert your answer here] 4. Would you consider the investment made in Project 4 optimally financed considering the proportion of debt that is bearable by LGI? How did the current WACC in Project 5 depart from the state of the firm in Project 1? [insert your answer here] 5. If you had to advise a potential investor interested in having a minority stake in LGI, what kind of information would you provide to help the investor make a decision? Would you be bullish or have reservations? Support your answer with facts and data from all MBA 620 projects as well as your budget projections. [insert your answer here]

View Related Questions